White space in terms of capital availability for the Real Estate Sector

In a nutshell

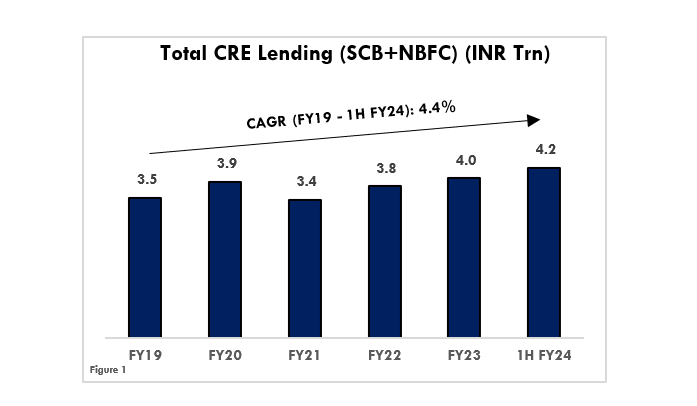

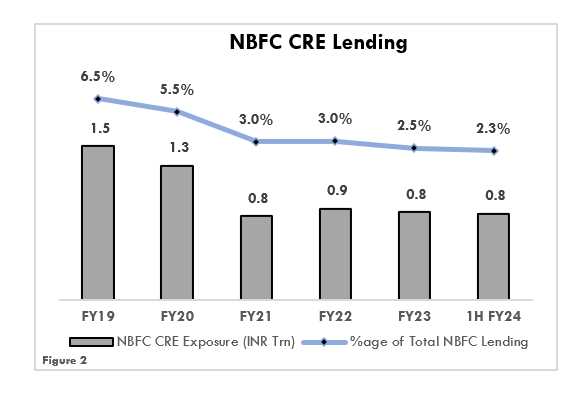

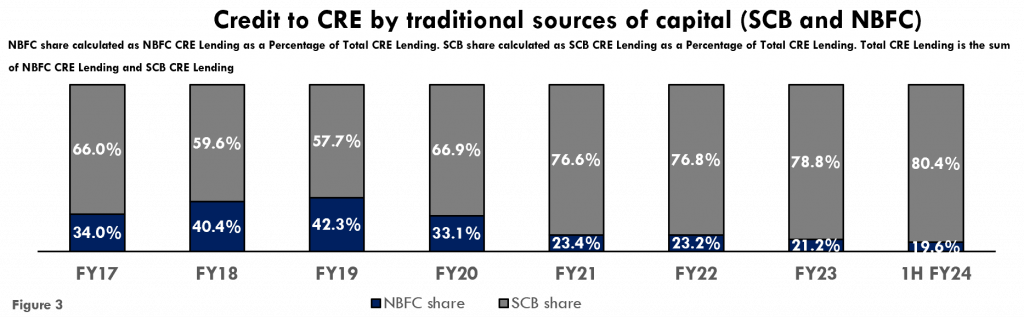

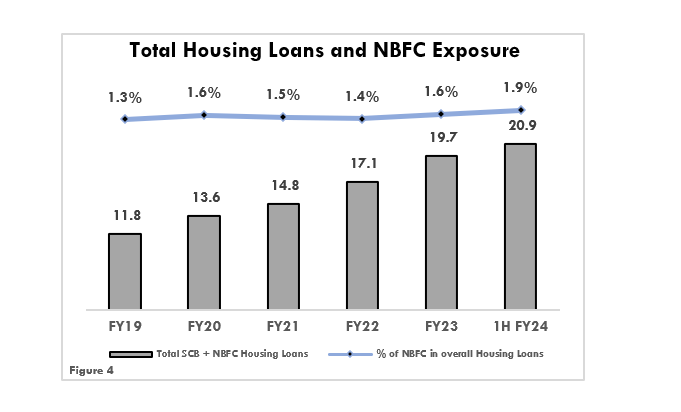

Banks are not meaningfully active to the real estate sector, while NBFCs have significantly vacated this space. There is a massive white space in terms of capital availability for performing, unlisted players. At the same time, the residential real estate sector is in the middle of a robust upcycle. This has led to a unique, attractive opportunity for creating a specialized credit platform to plug this funding gap.

Source Name:

Certus Capital, RBI