Real estate is a core sector for the Indian economy which is expected to reach a market size of US$1 trillion by 2030 and contribute ~13% to the country’s GDP by 2025(1). Within real estate, the residential segment has the largest contribution of ~80%.

After a prolonged 6-year down cycle, residential has seen a strong, broad-based recovery in the last 12 months, laying the foundation for an upcycle over next several years. Further, COVID-19 has provided a positive nudge to the sector already benefiting from a favorable macro setup.

Source: (1) IBEF, Sep 2021

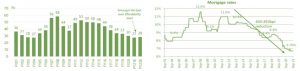

Strong bounce back in residential sales

Housing sale across tier 1 cities witnessed a sharp rebound in Q3 2021 – up 59% YoY. It also promptly recovered from second lockdown related disruptions in Q1 2021 – up ~250% QoQ.

Source: Proptiger real insights, Economic Times

Listed players (proxy for performing developers) continue to do exceptionally well

Performing, credible developers continue to gain market share as home buyers increasingly seek quality and assurance of timely delivery.

- Listed developers more than doubled (2.2x) their sales over the last 4 years – growth of 21% p.a. despite a slow market during these years

- Q3 2021 sales were 70%+ higher than the same quarter last year

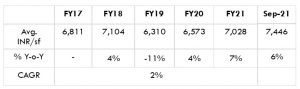

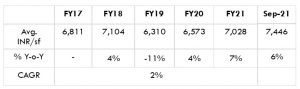

- Realizations have been increasing steadily – Q3 2021 realization was ~14% higher than same quarter last year and 6% higher than avg. realization in FY21

Source: Quarterly Investor Presentations

What is driving this stellar performance?

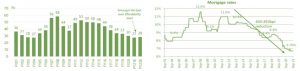

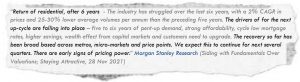

- Housing affordability is nearly the best it has ever been, driven by:

- All time low mortgage rates – 400-450 bps reduction in last 5 years

- Time correction in residential prices i.e. virtually no growth in capital values vs. income growth of ~8% p.a. and inflation of ~5%

Source: Morgan Stanley Research (India Property, 28 Nov 2021), Jefferies India Property: 2021 Outlook – A New Cycle Begins (Report dated 10 January 2021)

- Rising savings and wealth effect from buoyant capital markets

- COVID-19 catalyzing the need for home up-gradation and home ownership

- Supportive government policies – reduction in stamp duty, premium waivers/discounts, higher tax deductions for affordable homes, etc.

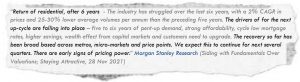

What are market experts / research houses saying?

What is the future outlook and how do you play this residential upcycle?

With the strong fundamentals in-place for the sector and low starting point of residential sale volume (~35-40% below last cycle peak in 2012-2013), we expect volume and price growth to accelerate over the coming years.

In our view, investments in senior secured credit (project finance) to the sector offer the best risk-reward to play this upcycle.