Pune has become one of the leading real estate destinations in India

In a nutshell

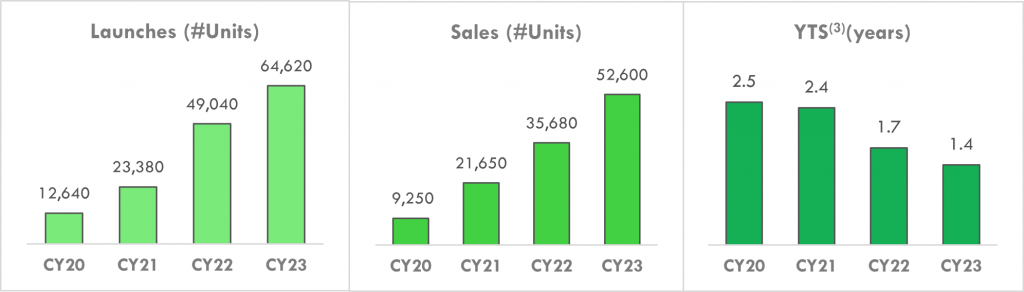

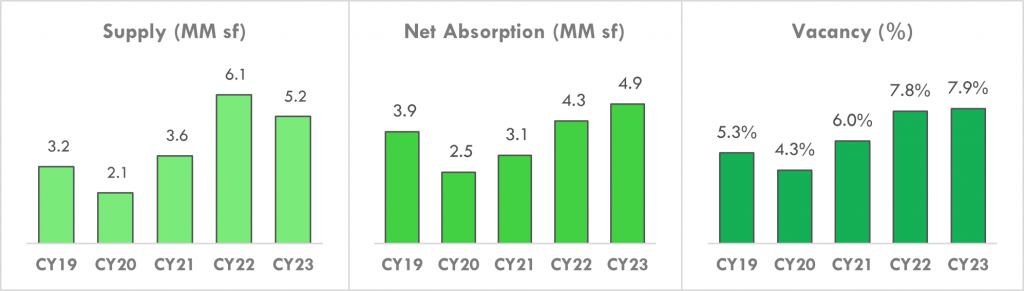

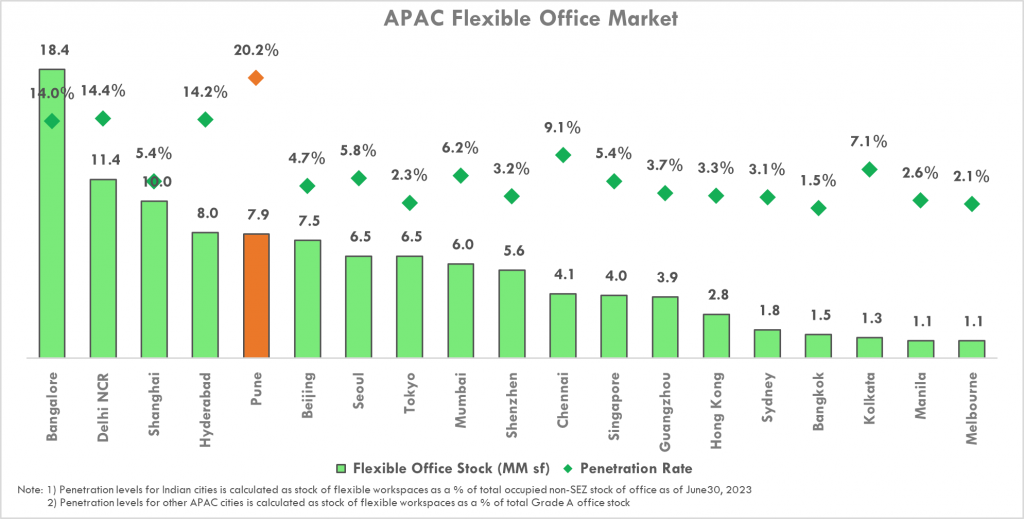

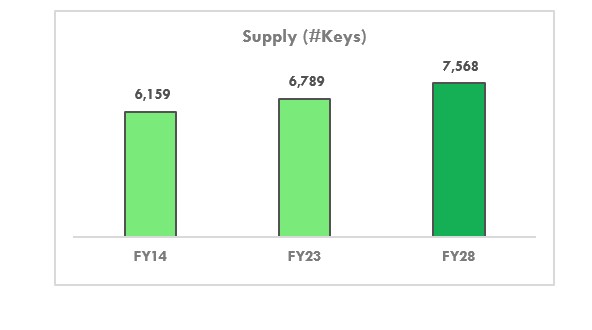

Pune has become one of the leading real estate destinations in India- a) 3rd largest city in terms of residential unit sales in CY23; b) Only major city in India with Grade A office vacancy levels in the single digits and c) highest penetration levels of flexible workspaces in India (as on Jun-23)

Source Name:

JLL, KnighFrank, Awfis DRHP (Dec 23)