Higher mortgage rates have been absorbed well

In a nutshell

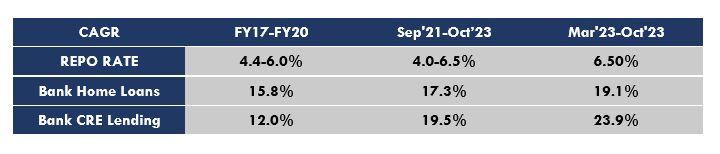

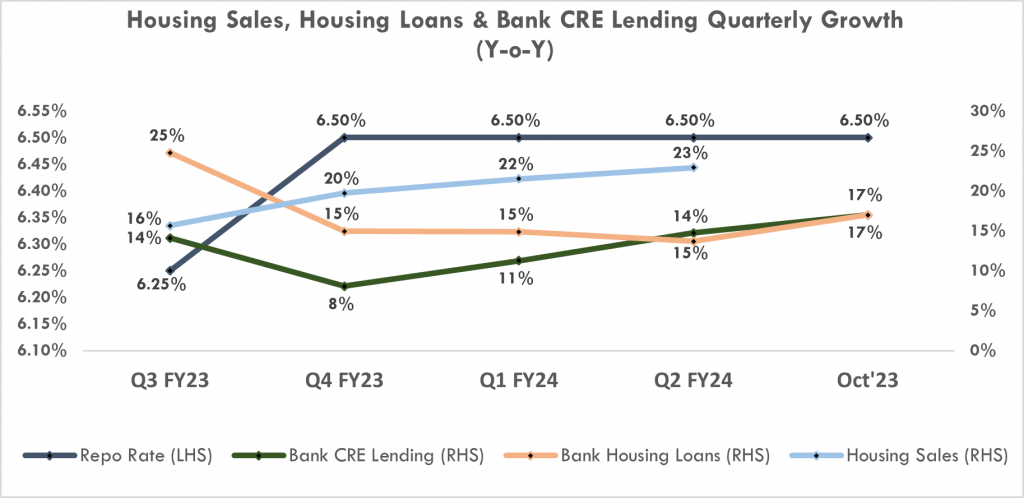

Residential sales, bank housing loans, and bank CRE loan have been resilient despite the 250bps rate hike and housing price surges showing that higher mortgage rates have been absorbed well.

Source Name:

Certus Capital