India is a large office market and typically leases ~35 – 40 million (‘MM’) square feet (sf) of Grade A quality office space per annum. Over the last two decades, India has established itself as a knowledge processor for the world. Many Fortune 500 companies across technology, financial services, IT services, consulting, manufacturing, etc. have setup large centres that cater to their global businesses. According to JLL’s Q2 2021 office market update, net office absorption averaged ~35MM sf between 2016 and 2019.

However, the onset of COVID in Mar 2020 dealt a massive blow to the office sector. Unlike retail malls, there wasn’t an immediate loss of rent from spaces leased to high quality companies (as they honored their contracts), but new leasing and renewals plummeted. Net office absorption slumped to ~26MM sf in 2020 from its usual level of ~35MM+ sf per annum.

As corporates adopted Work-from-Home (WFH), working through digital tools and online meetings became the norm. An early expectation was that the flexibility and cost arbitrage offered by WFH would lead to long-term increase in office vacancies. However, as the year panned out and the first lockdown was lifted, investment and leasing trends for commercial offices, across multiple parameters, have shown resilience. In 2020, India saw ~US$5.7Bn of institutional-grade office investment transactions (including capital raised by Indian REITs) with interest from institutions and retail investors alike.

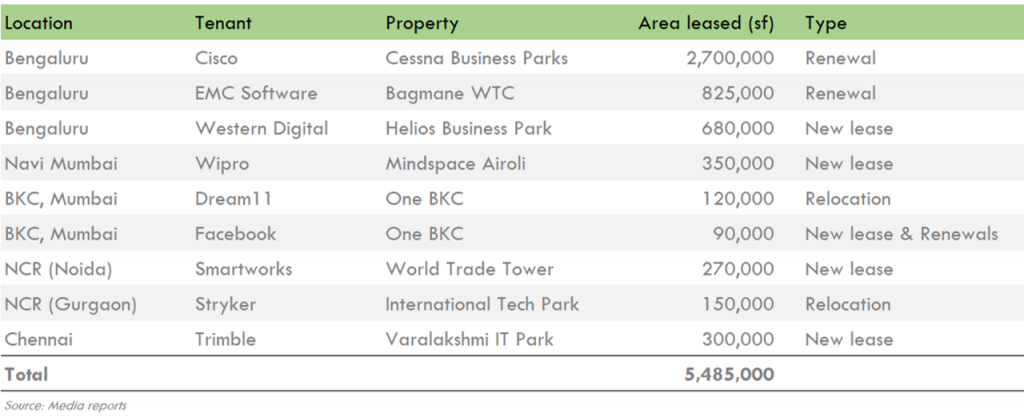

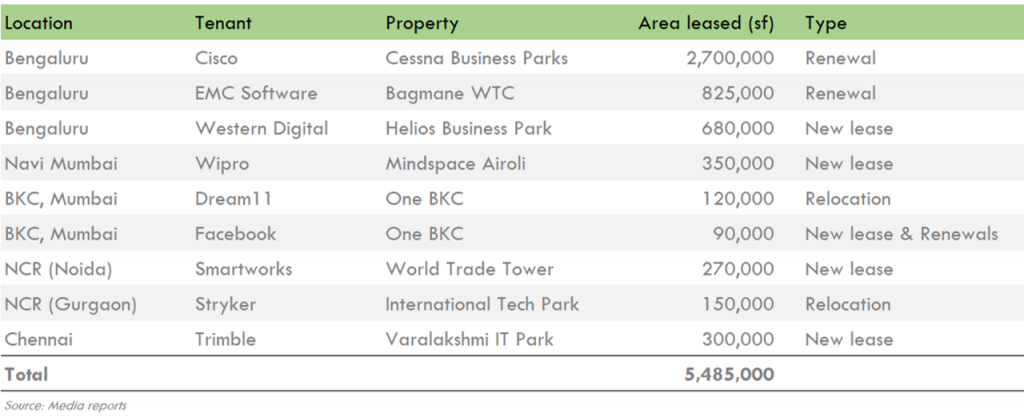

As the economy returns to normalcy, most employers seek to bring their employees back to office. Office space leasing witnessed a sharp uptick in Q3 2021 to ~12.5MM sf compared to ~4.7MM sf in the same quarter last year and ~3.6MM sf in the previous quarter (Source: Knight Frank research). This signals a reversion to pre-COVID leasing levels. Corporates have started closing on large space commitments. Few examples below:

So, is it all hunky-dory now? Not really but we feel that we are headed in the right direction. COVID certainly increased vacancies over the last year and it will take another year for this overhang to reduce. In this context, we like office investment opportunities with following characteristics:

- City centric locations where it is difficult to add new supply

- Stable micro-markets that attract varied industries

- Locked in (at least for 12 to 18 months) large corporate / MNC tenants that assure rental income, while the market improves further

Office development is an organized market and most developers resorted to deferment of new supply as COVID started. This is likely to lead to supply shortage in the medium term as markets rebound, especially for locations where supply is difficult to come by, such as Mumbai.

As the market stabilizes in the near-term, rentals, which have been range-bound so far, are expected to grow (gradual improvement in business conditions and limited new supply coming to market). We believe that thoughtfully selected city-centric office investments can deliver ~5 to 7% higher returns than fixed deposits and liquid debt funds but without the volatility of equity markets.