Chennai: The Epicentre of Tamil Nadu’s Real Estate Activity

In a nutshell

1. Given the diversified economic base, the demand for real estate across asset types has grown rapidly over the years in Chennai

2. Since 2018, Chennai real estate sector has witnessed ~USD 4 bn+ of private equity investments

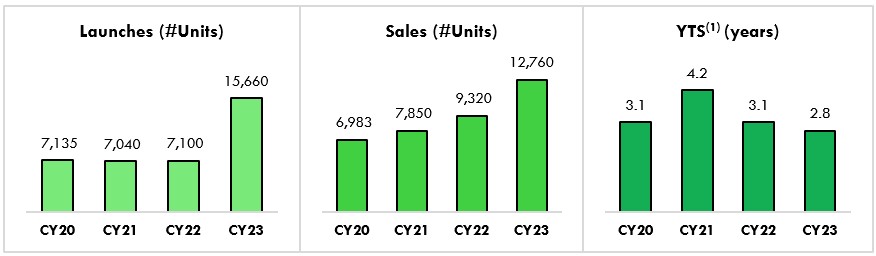

3. In CY23, Chennai residential market has exhibited a 37% y-o-y increase in residential sales, reaching 12,760 units

4. Unsold inventory (in terms of years to sell (YTS)) declined to 2.8 years in CY23 from 4.2 years in CY21

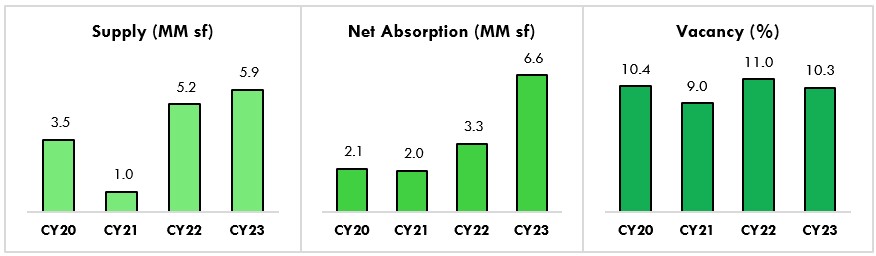

5. Net leasing absorption in CY23 rose to 6.6 msf, marking Chennai's strongest year